Intuit paycheck calculator

One of those tabs free paycheck calculator intuit is the Accounts menu where you can find and alter checks bank accounts and expense claims and create records for your payroll needs. Subtract any deductions and.

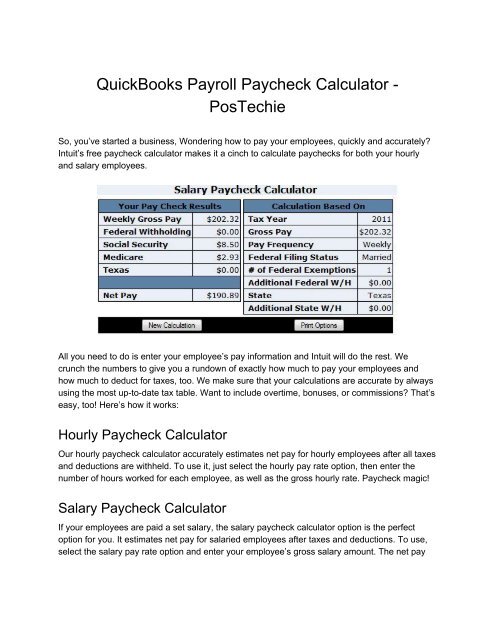

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

Ad Intuit Payroll Runs Payroll Instantly And Calculate Taxes.

. Our loan repayment calculator gives you an idea of what to expect should you decide to take out a loan. Get Started With ADP Payroll. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Cost of Living Calculator Tips to Negotiate a Cost of Living Adjustment. Try It Free Today. Make sure you arent using any browser plugins that could interfere with secure sign in.

How to calculate annual income. Must file by March 31 2022 to be eligible for the offer. Take home the paycheck you deserve.

Federal Salary Paycheck Calculator. You first need to enter basic information about the type of payments you make. Ad Intuit Payroll Runs Payroll Instantly And Calculate Taxes.

This includes a Tax Bracket Calculator W-4 Withholding Calculator Self-Employed Expense. Terms and conditions features support pricing. The tool then asks you.

Important note on the salary paycheck calculator. Make Your Payroll Effortless and Focus on What really Matters. Intuit Personal Loan Platform is a service offered by Intuit Financing Inc.

Ad Create professional looking paystubs. Ad Process Payroll Faster Easier With ADP Payroll. TurboTax offers a free suite of tax calculators and tools to help save you money all year long.

2022 Intuit Inc. Based on your annual taxable income and filing status your tax bracket. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. In a few easy steps you can create your own paystubs and have them sent to your email. Intuit and QuickBooks Workforce are registered trademarks of Intuit Inc.

Heres a step-by-step guide to walk you through. Ad Compare 5 Best Payroll Services Find the Best Rates. Salary commission or pension.

We use the most recent and accurate information. Try It Free Today. How to use a Payroll Online Deductions Calculator.

Includes state and one 1 federal tax filing. For example if an employee earns 1500. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

Get ideas on common industry. Get an accurate picture of the employees gross pay including. Your remaining loan balance.

Discover ADP Payroll Benefits Insurance Time Talent HR More. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Intuit reserves the right to modify or terminate this TurboTax Live Basic Offer at any time for.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Great for both employers and employees this tool helps calculate paychecks based on pay type pay rate bonus commission overtime federalstate taxes and. Your monthly loan payment amount.

This number is the gross pay per pay period. Use our Self Employed Calculator and Expense Estimator to find common self-employment tax deductions write-offs and business expenses for 1099 filers. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes.

Manually Enter Payroll Paychecks In Quickbooks Online

Turbotax W 4 Withholding Calculator Free W 4 Paycheck Calculator Turbotax Tax Refund Paycheck

Optimizing Ppc Conversions But Good Info For Any Online Marketing Method

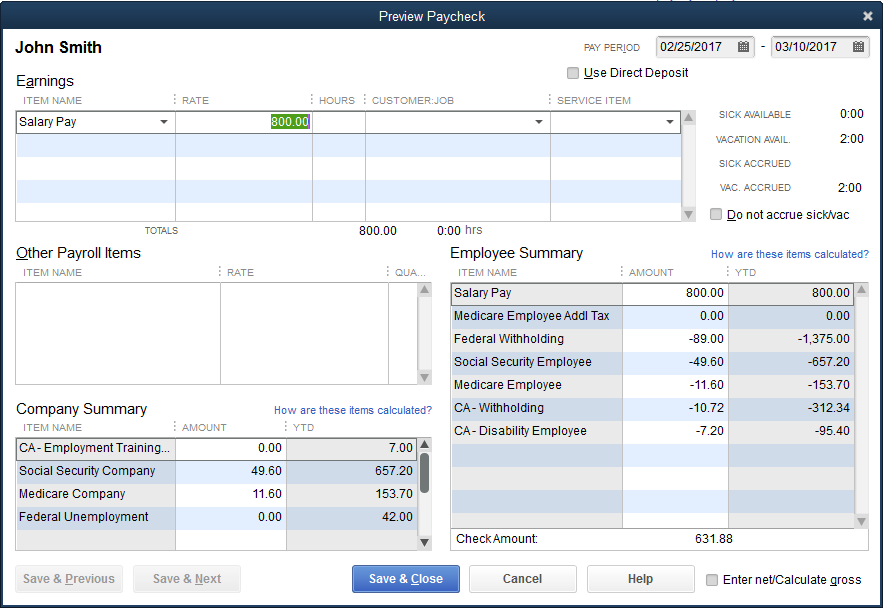

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

29 Free Payroll Templates Payroll Template Payroll Checks Invoice Template

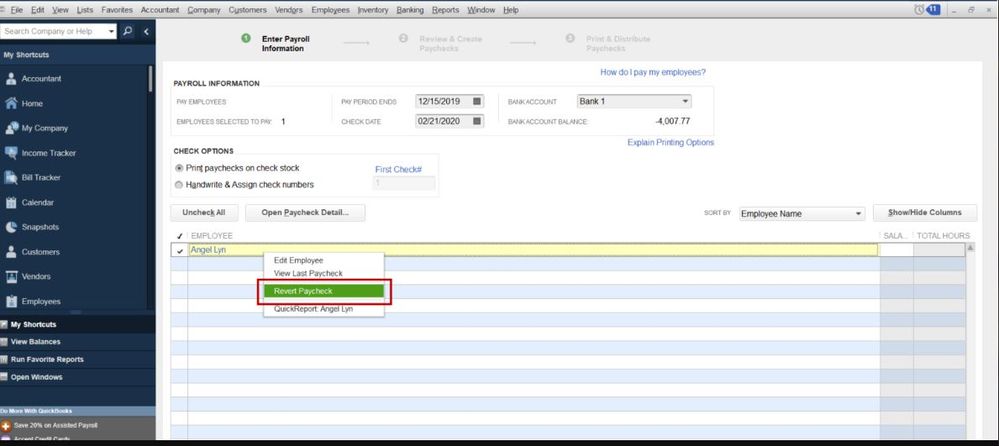

Desktop Payroll Taxes Suddenly Not Deducted

Why Choose Pos Software For Greenville Retailer Credit Card Machine Kids Grocery Store Toy Cars For Kids

R Finally There S One Place To Manage All Your Finances With Ease Mint Is The Free Money Manager And Financial Tracker App Mint App Finance App Budget App

Solved No Medicare Or Social Security Tax Taken Out Of One Employee S Check

How To Pay Off Debt Fast With A Low Income Debt Payoff Blog Taxes Tax Help

Solved Payroll Taxes Not Deducted Correctly

I Want To View An Employee S Pay With A Different Salary Outside Of Payroll How Would I Change The Salary To View The Tax Deductions And Net Pay Prior To A Payroll

Intuit Quickbooks Desktop Pro 2021 With Payroll Enhanced Windows

Study 10 Factors To Consider Prior To Purchasing Accounting Software Http Www Svtuition Org 2014 0 Accounting Education Accounting Software Learn Accounting

4 Reasons To Buy Your Home Now Page 2 Loveyourhome Realestate Buyinghomefall2015 Debt Service Pay Debt Love Your Home

Quickbooks Payroll Login Sign In Steps Quickbooks Payroll Quickbooks Payroll

Ca Covid Paid Sick Leave